Table Of Content

This includes damage from fire, smoke , wind, falling trees, hail, and theft. An insurance deductible is the amount subtracted from a claim check. For example, if you select a $1,000 deductible and have a kitchen fire repair that’s $5,000, your home insurance claim payout would be $4,000. You should buy enough liability insurance to cover what could be taken from you in a lawsuit. The rates in our analysis are estimates based on many factors, so your rate may differ.

Does homeowners insurance cover condos and apartments?

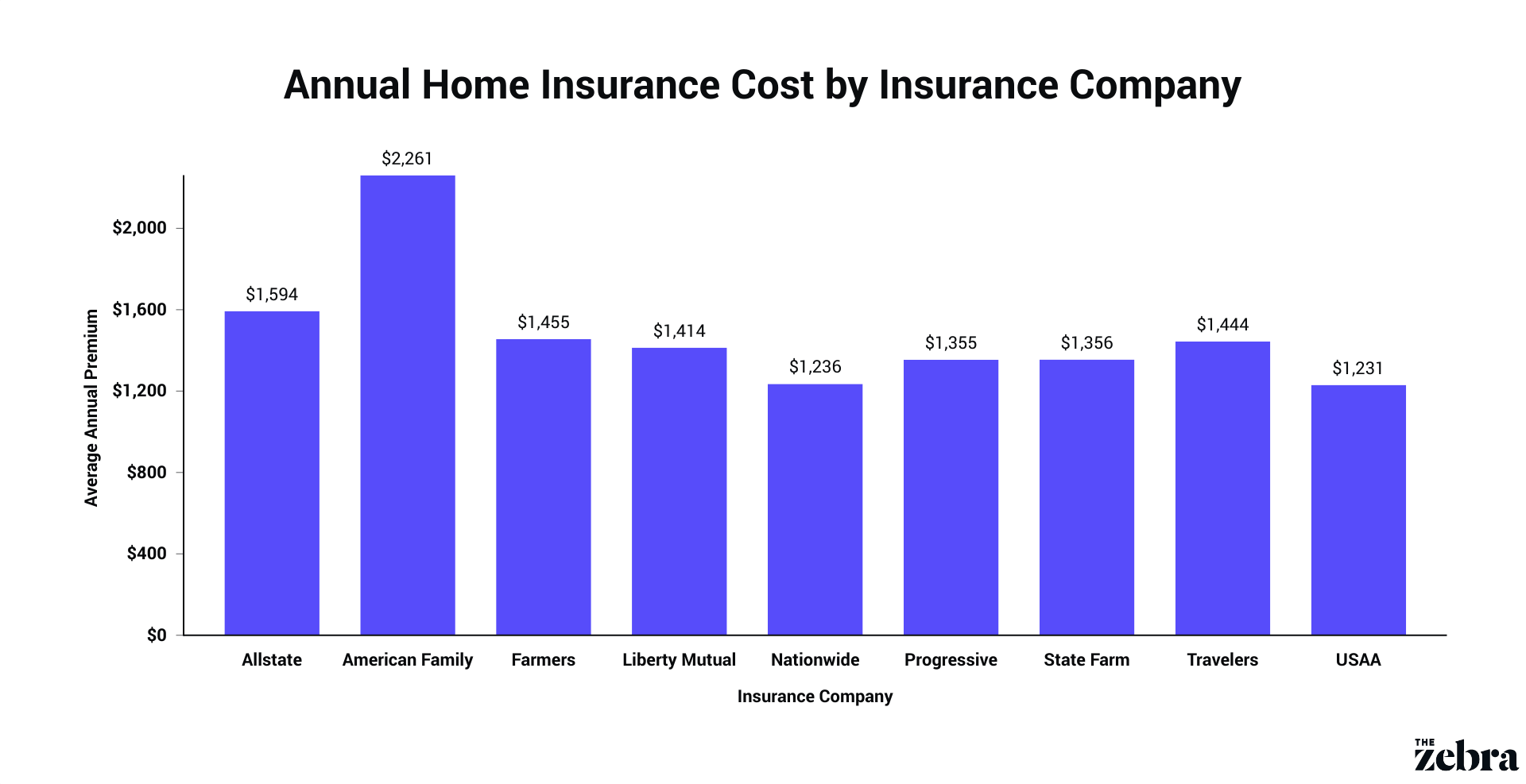

This is for a home insurance policy with $350,000 of dwelling coverage and $100,000 of liability coverage. You’ll want to compare quotes to choose the insurer and policy that offers the coverage you need at the most affordable cost. Look for companies that offer discounts, like money off for bundling your home and auto insurance.

Ask About Home Insurance Discounts

Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Shannon Martin is a licensed insurance agent and Bankrate analyst with over 15 years of experience in the industry. She enjoys helping others navigate the insurance world by cutting through complex jargon and empowering readers to make strong financial decisions independently.

Annual premium: $2,035

Choosing Company B saves you a little money because of slightly lower limits and the hefty $2,500 deductible. USAA is best known for its military-focused coverage, inexpensive premiums and high customer service ratings. Its well-rounded insurance offerings helped it tie for Best Home Insurance Company Overall in the 2024 Bankrate Awards. Although not officially ranked due to eligibility restrictions, USAA earned a score of 881/1,000 in the 2023 J.D. Power Home Insurance Study — the highest score of all the companies included. USAA also has a lower-than-average premium for home policies with $300K in dwelling coverage, according to proprietary rate data, and your belongings are automatically insured at replacement cost value.

Below are some of the most asked questions about homeowners insurance. Check our home insurance FAQ and home insurance resources page for more information. We are temporarily unable to provide services in Spanish for Colorado residents. GEICO Insurance Agency, Inc. has partnered with to provide insurance products. When you click "Continue" you will be taken to their website, which is not owned or operated by GEICO.

The best way to find out how much personal property coverage you need is by taking an inventory of your personal belongings. The first quote has a lower dwelling limit, but a higher liability limit and a slightly higher deductible than the second quote. If you file a claim for damage to your home, you’ll have to pay $1,500 out of pocket — your deductible limit — if you purchase the first quote, and only $1,000 if you purchase the second quote.

On average, homeowners with a poor credit score pay about twice as much for home insurance than homeowners with good credit. It's common for dwelling coverage to be RC and property coverage to be ACV. HO-3 policies typically pay out claims at actual cash value for your belongings, while HO-5 policies cover them at replacement cost. If you want coverage for a condo, you’ll need to buy a condo insurance policy, also known as an HO-6 insurance policy. Condo insurance is similar to home insurance in that it covers repairs to the interior of your condo unit, your personal belongings, liability, medical payments to others and additional living expenses. The exterior of the building is covered by the homeowner association’s master policy.

It may not make financial sense to join AAA solely for its home insurance policies, but some homeowners may be interested in AAA’s other perks, like its travel discounts and famous roadside assistance. The liability insurance within a homeowners policy pays for injuries and property damage you accidentally cause others. For example, if your dog bites someone, your liability insurance can cover the medical expenses. Liability insurance also covers your legal expenses if you’re sued over the incident. Nationwide’s standard homeowners policies include ordinance or law coverage, which pays to bring your home up to the latest building codes after a covered claim. They also include coverage for unauthorized credit or debit transactions.

Allstate also won a Bankrate Award for Best for Bundling Home and Auto Insurance. Policyholders have the flexibility to purchase a policy, make changes or pay bills directly with its extensive network of agents or independently via the mobile app. Allstate advertises nine different endorsements and plentiful discount opportunities to help reduce your premium. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

4 Best Homeowners Insurance Companies in Jacksonville (2024) - MarketWatch

4 Best Homeowners Insurance Companies in Jacksonville ( .

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

Your past claims history reveals that you tend to make a lot of claims, making you riskier to insure. That shows the issues of previous homeowners that could also affect you. Here are the insurers we found with average annual rates equal to or below the California average.

Prices, coverages and privacy policies vary among these insurers, who may share information about you with us. PAA's compensation from these insurers may vary between the insurers and based on the policy you buy, sales volume and/or profitability of policies sold. See a list of all the insurers that write Progressive Home policies, or contact us for more details.

Open-peril coverage works by covering everything that's not specifically excluded in the policy, while named-peril coverage protects against causes that are specifically named or listed in the policy. If your home insurance premium is higher than your state average, it may be time to consider switching companies. No, a standard home insurance (HO-3) policy does not cover condominiums or rental units. However, most lenders will require proof of home insurance before you can close on a property. And with an average premium of $1,650 per year, you can expect your Allstate insurance home quote estimate to hover right around the national average.

Whether you want to switch companies to save money, purchase homeowners insurance for your first house or are just window shopping, comparing companies is a great way to get your best rates and coverage. We know that companies can begin looking the same the more quotes you get. Your personal property coverage limit is typically 50% of your dwelling coverage. However, you can lower or raise the amount of coverage based on the value of your belongings.

Andover also offers replacement cost coverage on your personal belongings, which ensures you’ll get more for stolen or destroyed items than you would if you had actual cash value coverage. Below are three sample homeowners insurance quotes and thoughts on how you might compare them. For example, you may have a $1,000 deductible for most disasters but a 3% deductible for hurricanes. On a house with $300,000 of dwelling coverage, you’d pay for $9,000 of hurricane damage before your insurance company would pay anything. You can calculate your dwelling coverage limit with an online dwelling coverage calculator, a professional appraisal, or by finding out the build price per square foot in your area and estimating it yourself.

Say your home has a $200,000 dwelling limit but is covered up to 125% with extended replacement cost coverage. So you’d have up to $250,000 to rebuild your home if you needed it. Finding the right homeowners insurance company for you can be overwhelming.

Homes with pools, trampolines, or even dogs will also see higher home insurance rates due to the increased risk of an injury on the premises. Answer a few questions to get a free estimate of your rates and coverage needs with our home insurance calculator. Help protect your largest investment and your budget with homeowners insurance. We also offer insurance policies for owners of second homes and vacation homes. This way, you, your family and your guests are protected wherever you go. Home insurance can also be used as a means of financial protection.